NEXUS: New Launch of Bangkok Condominium in 2017 Hits New Record in a Decade with Luxury Segment Continuing to Boom. Market Should Keep an Eye on Investment Groups and Buyers from Hong Kong, China and Japan.

– Future trend: project should apply technology to complete customer’s lifestyle and prepare for senior citizen society.

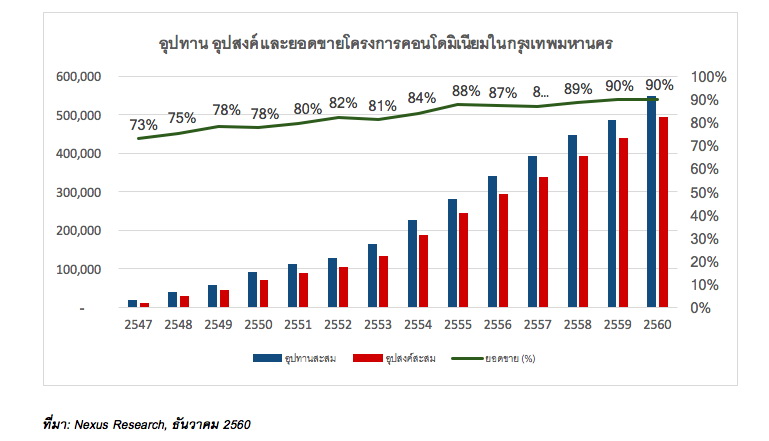

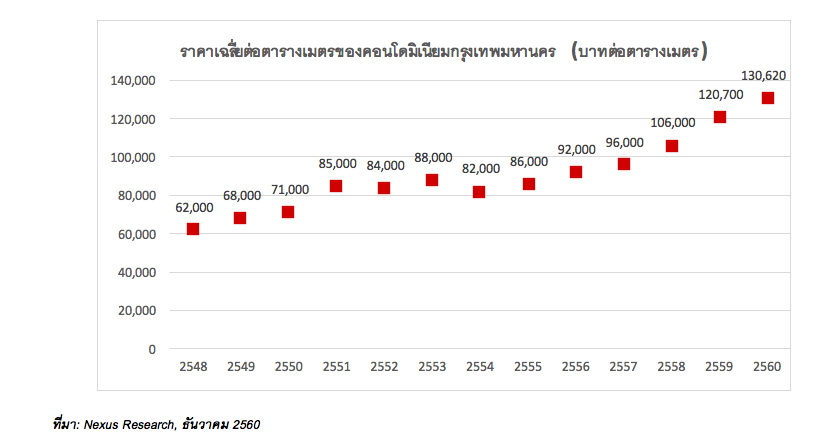

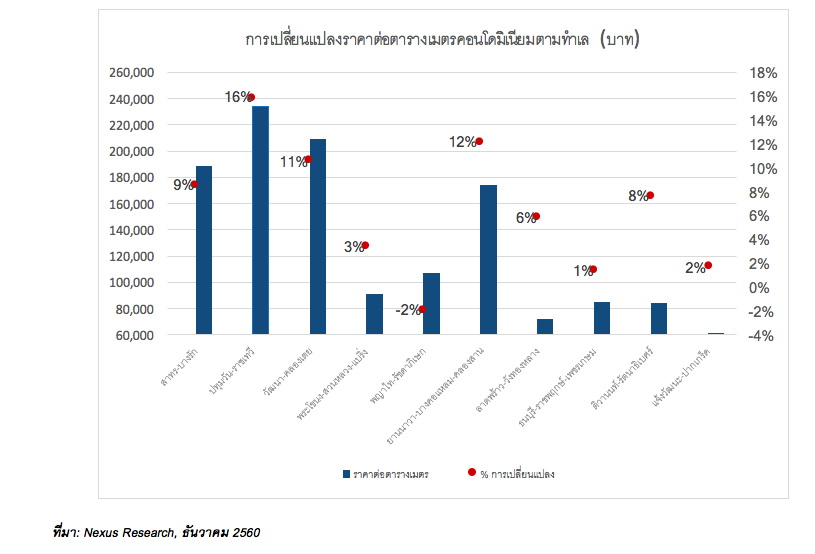

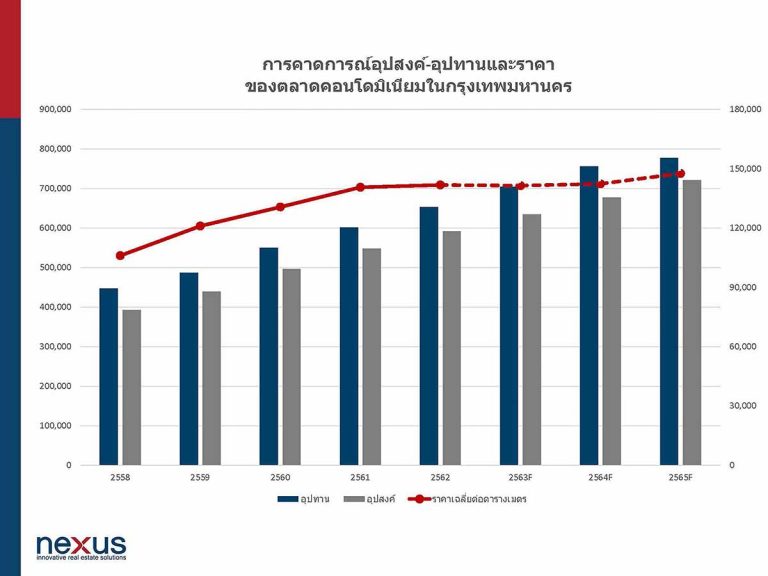

Nexus discloses that Bangkok condominium in 2017 booms and hits a new record high with the largest number of new supply launch in a decade. The Phra Khanong—Suan Luang area remains attractive with the largest number of new project launched. The Pathumwan—Ratchathewi area sees the highest increase in prices with a rise of up to 16%. Market in 2018 will continue growing with an increase of over 10% in a number of new supply being launched. Nexus points that a future residential trend will move to a “transition” situation, being driven by various factors including an investment of foreign investors, an exponential growth of CLMV, an upcoming society of senior citizen in the country and technology influencing on new property development.