Generalist and international investors to drive 2020 global hotel investment volume

JLL report reveals key global trends across hotel markets

Investor sentiment for hotel product remains cautiously optimistic, as investors navigate international, political and economic dynamics in addition to the recent coronavirus outbreak in China. According to JLL Hotels & Hospitality’s annual Hotel Investment Outlook (“HIO”), a forward-looking, global analysis of trends affecting the hotel investment market, global hotel transaction activity will be shaped by record levels of real estate fund-raising and interest from new buyers.

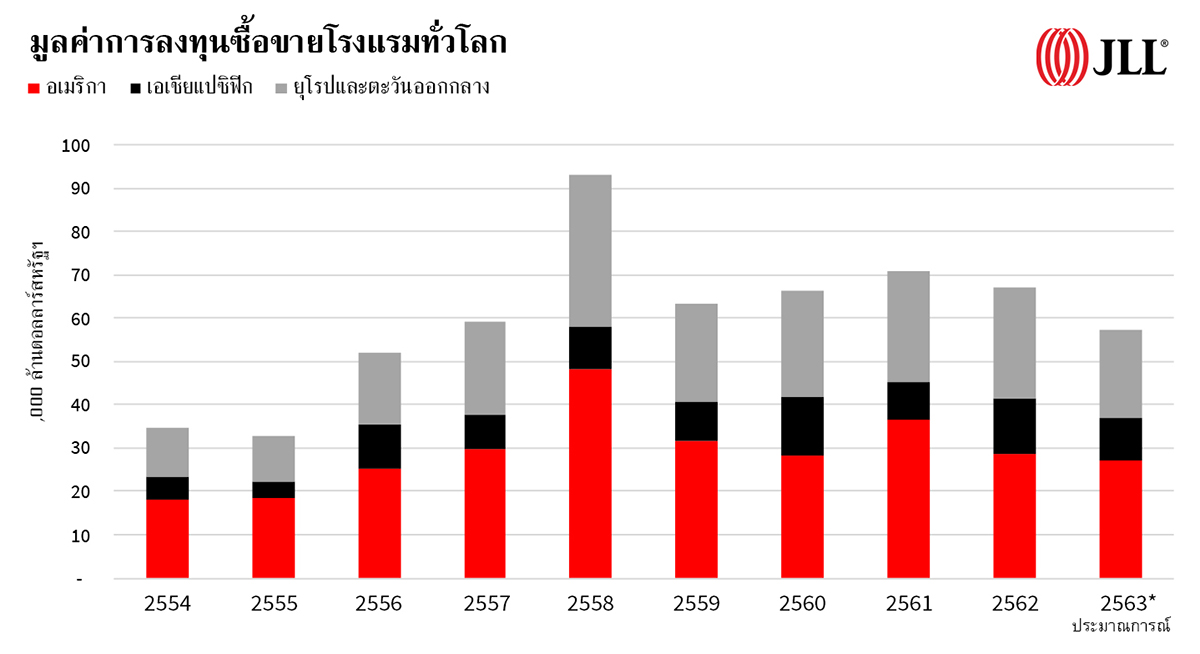

Global hotel transaction volumes in 2019 reached US$66 billion, bolstered by a resilient global economy and continued demand from domestic and international travelers. However, the length of the current market cycle, trade conflict and ongoing uncertainty surrounding Brexit gave investors cause to feel more cautious, which led to a 6 percent decrease in total hotel market liquidity compared with 2018. In 2020, global hotel liquidity is expected to decrease approximately 10-15 percent as investors adopt a slightly more selective approach. Yet, the pipeline in deal flow activity will continue across all regions through 2020.