PropertyGuru Reports Second Quarter 2023 Results

Revenues of S$37 Million and Adjusted EBITDA of S$5 Million

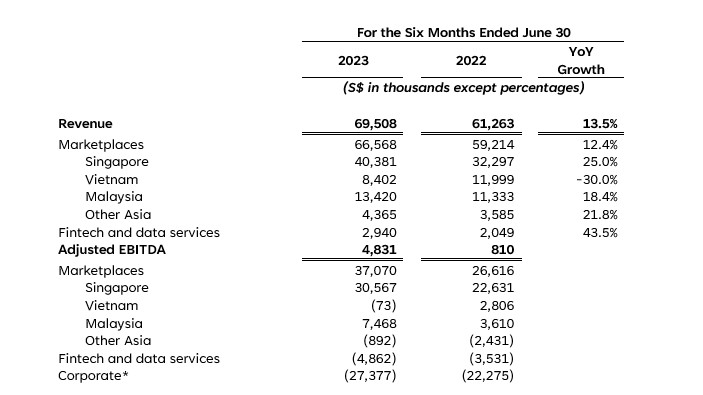

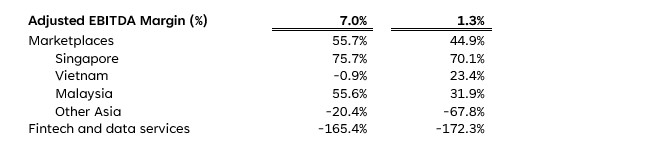

– Total revenues grew 12% to S$37 million in the second quarter of 2023, as total revenues ex-Vietnam grew 22%

– Active cost management drove 113% of incremental year over year revenue into Adjusted EBITDA[1]

– Adjusted EBITDA grew to S$5 million in the second quarter 2023, up from S$0.3 million in the second quarter of 2022

PropertyGuru Group Limited (NYSE: PGRU) (“PropertyGuru” or the “Company”), Southeast Asia’s leading , property technology (“PropTech”) company, today announced financial results for the quarter ended June 30, 2023. Revenue of S$37 million in the second quarter of 2023 increased 12% year over year. Net loss was S$6 million in the second quarter and Adjusted EBITDA was positive S$5 million. This compares to net income of S$4 million and Adjusted EBITDA of positive S$0.3 million in the second quarter of 2022.

Management Commentary

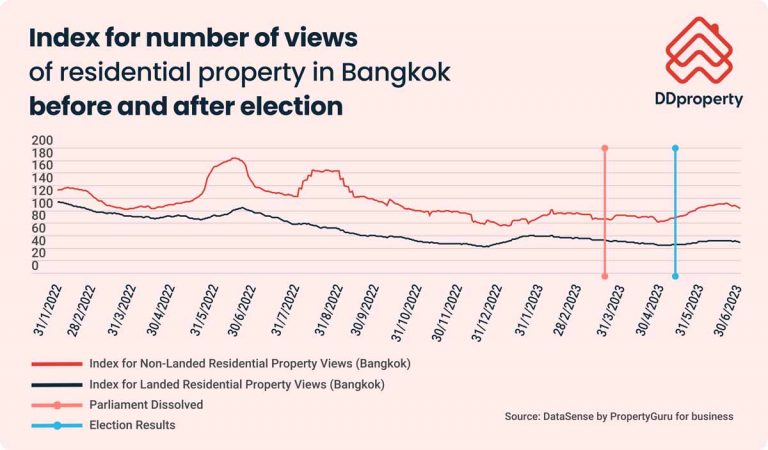

Hari V. Krishnan, Chief Executive Officer and Managing Director, said “PropertyGuru delivered a good quarter of double-digit revenue growth and a double-digit Adjusted EBITDA margin, standing firm in a Southeast Asian economy wrestling with inflation and rising interest rates. This was the result of focused investments and execution despite ongoing macro challenges in Vietnam, where last year’s government interventions in the property market continue to impact consumer sentiment and transaction volumes.

Our focus on leveraging generative AI has bolstered our market-leading products while driving improvements in code quality and engineering productivity. In June, we launched GuruPicks, an automated and personalised feed of property listings based on machine learning algorithms, and upgraded our AI image moderation engine to continue to enhance listing quality.

Earlier this week, we made strategic decisions to phase out our Indonesia marketplace business, Rumah.com, and sunset one of our SaaS products, FastKey. We regularly review our progress as a business and take necessary steps to optimize our resources. These actions align with our time-tested approach to focus our investments on businesses with strong unit economics that have shown the potential to achieve scalable growth. We acknowledge the impact of these decisions on our valued teams. I would like to extend my heartfelt gratitude to the impacted Gurus for their contributions to the Group and wish them the very best in their future endeavors.”