Asia-Pacific Residential Review

The Asia-Pacific Residential Review is an investor focused report which provides an in-depth look at the performance of the mainstream residential markets across the region.

“The residential market experienced a surge in the past six months, following the FED’s decision to pause rate hikes, which encouraged potential buyers who had been waiting on the sidelines to make purchasing decisions. Ongoing constraints on the supply side, including input costs, labour shortages and construction delays,

have played a role in supporting prices in numerous cities across the Asia-Pacific region. Notable performers such as Singapore, Sydney, Brisbane, Perth, Manila, Delhi, and Bengaluru have benefited from factors like the wealth effect, demand exceeding supply, and optimistic economic growth prospects.”

KEVIN COPPEL, MANAGING DIRECTOR, ASIA-PACIFIC

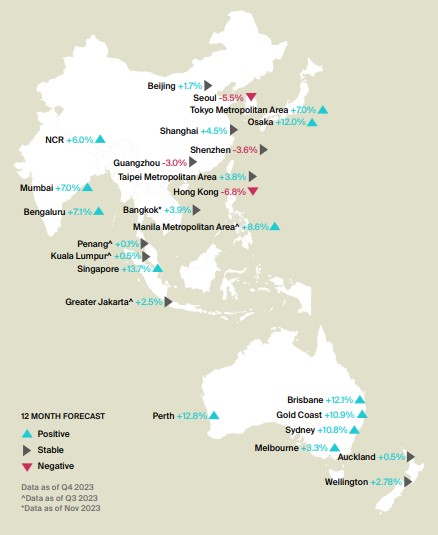

4.5% Average year-on-year residential price growth in H2 2023

21 Of 25 cities monitored recorded positive annual price growth in H2 2023

Singapore Top performing market with 13.7% YoY growth

Cautiously Optimistic Outlooks across Asia-Pacific as rate hikes take a pause Optimistic

NOTABLE RECOVERY OF THE RESIDENTIAL MARKET IN APAC

In the Asia-Pacific (APAC) region, there has been a notable acceleration in price recovery, driven by peaking interest rates and declining inflation. Knight Frank’s tracking of 25 cities reveals that 21 experienced positive or stable year on-year (YoY) growth in the second half of 2023, a significant improvement from the 14 cities in H1 2023. The price reversed from a contraction of 0.2% in H1 2023 to a 4.5% growth in H2 2023. Despite challenges such as a sharp increase in mortgage rates affecting housing affordability across markets like Hong Kong to South Korea, rebounding demand amid low supply pipeline has instilled buyer confidence, creating upward pressure on prices. While it is anticipated that the cycle of rate hikes may be concluding, uncertainties persist regarding the strength of the recovery in a higher-for longer rate environment.

SOUTHEAST ASIA (SEA)

Singapore’s mainstream housing market defied expectations with the strongest APAC growth at 13.7% YoY.

Despite a quieter sales market and reduced launches due to a challenging macro-economic environment and

higher acquisition costs following cooling measures in April 2023, Singapore remains a safe haven, attracting talent and maintaining population growth. This, coupled with the wealth effect, is expected to support stable prices despite a decline in transaction volumes. In the Manila metropolitan area, prices surged by 8.6% YoY, driven by the resumption of Business Process Outsourcing (BPO) firms. This has led to an increasing number of expats returning to oversee business operations, contributing to the area’s strong performance.

AUSTRALASIA

In December 2023, the Reserve Bank of Australia (RBA) maintained its official cash rate target at 4.35%. Anticipated impacts on current mortgage holders from prior consecutive interest rate hikes have been relatively minimised. Across major Australian cities, there is a shared challenge of elevated construction costs and limited supply, resulting in an upward trajectory for property prices and rents. This trend is expected to continue into 2024, driven by sustained demand, scarce new stock, and robust immigration nationwide. With the exception of Melbourne (up by 3.2% YoY), the rest of the Australian major cities, namely Perth, Sydney, Brisbane, and Gold Coast’s mainstream residential markets, all experienced double-digit H2 2023 The Asia-Pacific Residential Review is an investor focused report which provides an in-depth look at the performance of the mainstream residential markets across the region. Asia-Pacific Residential Review “The residential market experienced a surge in the past six months, following the FED’s decision to pause rate hikes, which encouraged

potential buyers who had been waiting on the sidelines to make purchasing decisions. Ongoing constraints on the supply side, including input costs, labour shortages and construction delays, have played a role in supporting prices in numerous cities across the Asia-Pacific region. Notable performers such as Singapore,

Sydney, Brisbane, Perth, Manila, Delhi, and Bengaluru have benefited from factors like the wealth effect, demand exceeding supply, and optimistic economic growth prospects.” KEVIN COPPEL, MANAGING DIRECTOR, ASIA-PACIFIC growth in 2023, ranging between 10.8% and 12.8% YoY. Prices are expected to

rise by mid-range single digits in 2024. In New Zealand, the housing market has exhibited signs of stabilisation and has recovered some of its losses since reaching a floor in the second half of 2023. Prices in Wellington and Auckland rose by 2.75% and 0.5% YoY, respectively, reversing the trend from the earlier double-digit declines.