10 Largest Real Estate Developers in Thailand

AP (Thailand) Public Company Limited has been crowned champion for the fifth consecutive year as the largest developer in the Bangkok Metropolitan Region (BMR). BMR housing markets is considered to be half of the total housing market in the country.

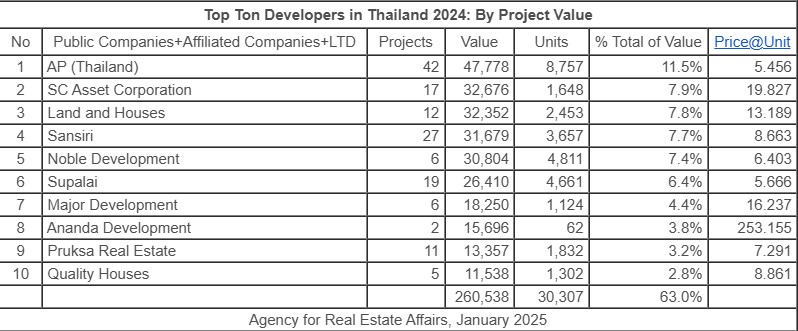

Dr. Sopon Pornchokchai, President, Agency for Real Estate Affairs (www.area.co.th) announced the results of the housing market survey at the end of 2024, finding that the leader in the real estate industry is AP (Thailand) Public Company Limited, which launched a total of 42 projects, 8,757 units, worth 47,778 million baht (USD 1.405 billion), with an average price of 5.456 million baht (USD 160,471), being the “champion” in terms of both the number of units and the development value.

AP (Thailand) Public Company Limited, which developed 8,757 new units, is 14.2% of all sales units opened in 2024 or about one-seventh of the total. In terms of the value of the development launched at 47,778 million baht, it is 11.5% of all launched at a value or about one-ninth of the total value, which is considered very high, much higher than the next-ranked companies.

In terms of number of units, the companies that developed in 2nd-5th place were Noble Development PCL in 2nd place , Supalai PCL in 3rd place , Sansiri PCL in 4th place , and AssetWise PCL in 5th place . In terms of development value, it turned out that the 2nd place was SC Asset Corporation PCL, 3rd place was Land and Houses PCL, 4th place was Sansiri PCL, and 5th place was Noble Development PCL.