Bangkok Housing Market Outlook, 2025

As expected, the Bangkok Metropolitan Region housing market, which is the largest market of about half of Thailand, declined in 2024, with new project launches falling significantly from 462 projects in 2023 to 375 projects in 2024, or a decrease of -19%. Development value fell from 559,743 million Baht in 2023 to 413,773 million Baht in 2024, or a decrease of -26%. The number of new units launched fell from 101,536 units in 2023 to 61,453 units in 2024, or a decrease of -39%. However, it is expected to recover by 10% in 2025.

Recently, Dr. Sopon Pornchokchai, President, Agency for Real Estate Affairs Co., Ltd. (www.area.co.th) which is the largest real estate information and valuation centre since 1991, organized a seminar on the direction of the housing market in 2025 at the Royal Orchid Sheraton Hotel, Bangkok, and announced the latest situation at the end of 2024 and future directions.

At the end of 2024, AREA found that there were 3,028 residential projects still offering residential products in the market, with a total of 837,090 units surveyed, with a combined value of 3,850,428 million Baht (USD 113.25 billion). Dr. Sopon therefore stated that this survey is considered the most comprehensive survey of projects. AREA has conducted this survey since 1994, so it has the most updated data in Thailand and could be continuously compared.

In detail, it can be said that there are projects with more than 20 units remaining, which shows that there are still continuous sales (active) of 2,690 projects. These projects would be offered for sale in 2025. When compared to the end of 2023, it was found that at that time there were 2,927 residential projects still offering residential products in the market, with 2,425 projects with more than 20 units remaining.

The figures above show that there are still 101 projects that are pending and unable to close sales (from 2,927 projects to 3,028 projects) or 3.45%, which is not considered a large increase. However, projects with more than 20 sales units waiting for sale have increased by 10.93% (from 2,425 projects to 2,690 projects), showing that currently the projects that are still active are pending and unable to be sold, increasing significantly.

The launch of new projects had clearly decreased from 462 projects in 2023 to 375 projects in 2024, or a decrease of -19%. In terms of development value, it has decreased from 559,743 million Baht in 2023 to 413,773 million Baht in 2024, or a decrease of -26%. In terms of the number of units, it had decreased from 101,536 units in 2023 to 61,453 units in 2024, or a decrease of -39%.

The reason why the number of units fell so much compared to the value that fell so little is because the launch of new projects had focused more on expensive products. Cheaper products were harder to sell than more expensive ones. It could be seen that the average house price increased from 5.513 million Baht (USD 162,147) per unit in 2023 to 6.733 million Baht (USD 198,029) in 2024, or an increase of 22%. The average price of residential properties offered for sale has been increasing steadily, with the average price in 2022 being only 4.412 million Baht (USD 129,765). Before COVID-19, the price of houses offered for sale in the market in 2019 was only 3.937 million Baht (USD 115,794).

In terms of the value of newly launched developments of 413,773 million Baht or USD 12.170 billion) in 2024, this year there was a sales value of 324,915 million Baht or USD 9.556 billion (both newly launched and previously launched products), equivalent to 79% sales. In terms of the number of newly launched units of 61,453 units in 2024, this year there were 58,779 units sold (both newly launched and previously launched products), equivalent to 96% sales. In this case, Dr.Sopon explained that the number of products sold was about the same as the number of newly launched products. The market glut may not be as much as many parties are worried about.

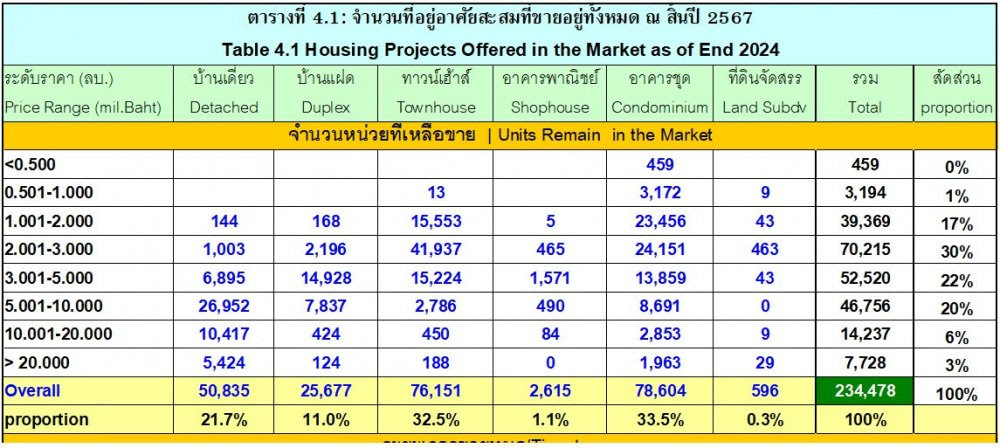

From a survey of 837,090 housing projects, it appears that 72% have been sold, with only 28% remaining for sale, or a total of 234,478 units. When compared to the end of 2023, there were 233,433 units left to be sold in 2024, but at the end of 2024 there were 234,478 units left to be sold in 2025, or an increase of 0.45%, indicating that the overall excess supply has not increased as much as previously understood.

The remaining supply from 2024 that will be sold in 2025 is mostly condominiums, 78,604 units or 33.5%, followed by townhouses, 76,151 units or 32.5%, and detached houses, 50,835 units or 21.7%, semi-detached houses, 25,677 units or 11%, and the rest are commercial buildings (shophouses) and very little land subdivision projects. As observed, semi-detached houses were developed a lot, to the point that it was about half of detached houses because by law, semi-detached houses had a size of no less than 35 square wah (140 sq.metres or 1,510 sq.feet), while detached houses must have a size of 50 square meters (200 sq.metres or 2,153 sq.feet) or more.