Frasers Property Thailand reports nearly THB 15 billion in revenue for FY2024, expands industrial portfolio to 3.6 million sqm and maintains strong office and retail occupancy of 92%

Frasers Property (Thailand) Public Company Limited (“FPT”) reported THB 14,566 million in total revenue and THB 1,467 million in profit in FY2024 (October 2023 – September 2024). A decrease in revenue as a result of multiple challenges facing the residential business was partly offset by robust growth in the recurring income business in the financial year. FPT recorded surging demand for industrial and logistics properties in Thailand, Indonesia, and Vietnam, which helped drive overall portfolio occupancy to a new high of 87%. Its office and retail business also maintained a strong occupancy rate of 92%. The company is set to pay a dividend of THB 0.31 per share on 11 February 2025.

Mr. Thanapol Sirithanachai, Country Chief Executive Officer of Frasers Property (Thailand) Public Company Limited, stated, “The company remained relatively resilient due to its fully integrated real estate platform encompassing residential, industrial, and commercial business. Our industrial business benefitted from continued demand for factory and warehouses as a result of companies’ China Plus One strategy, which helped to drive occupancy rate for our industrial portfolio to an all time high. This diversification helped to cushion impact to FPT’s revenue and profit despite various economic pressures. FPT maintains a strong business and financial position, with a credit rating of “A” and a “Stable” outlook for the fourth consecutive year from TRIS Rating. We continue to advance our ’Real Estate as a Service Brand’ strategy, driving sustainable business growth for the company.”

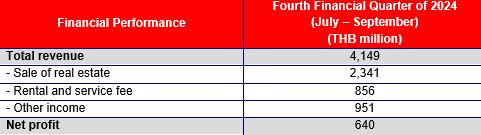

FPT’s total revenue for FY 2024 of THB 14,566 million comprised THB 9,174 million from property sales, THB 3,131 million from rental and services, and THB 2,261 million from other sources. Net profit stood at THB 1,467 million.