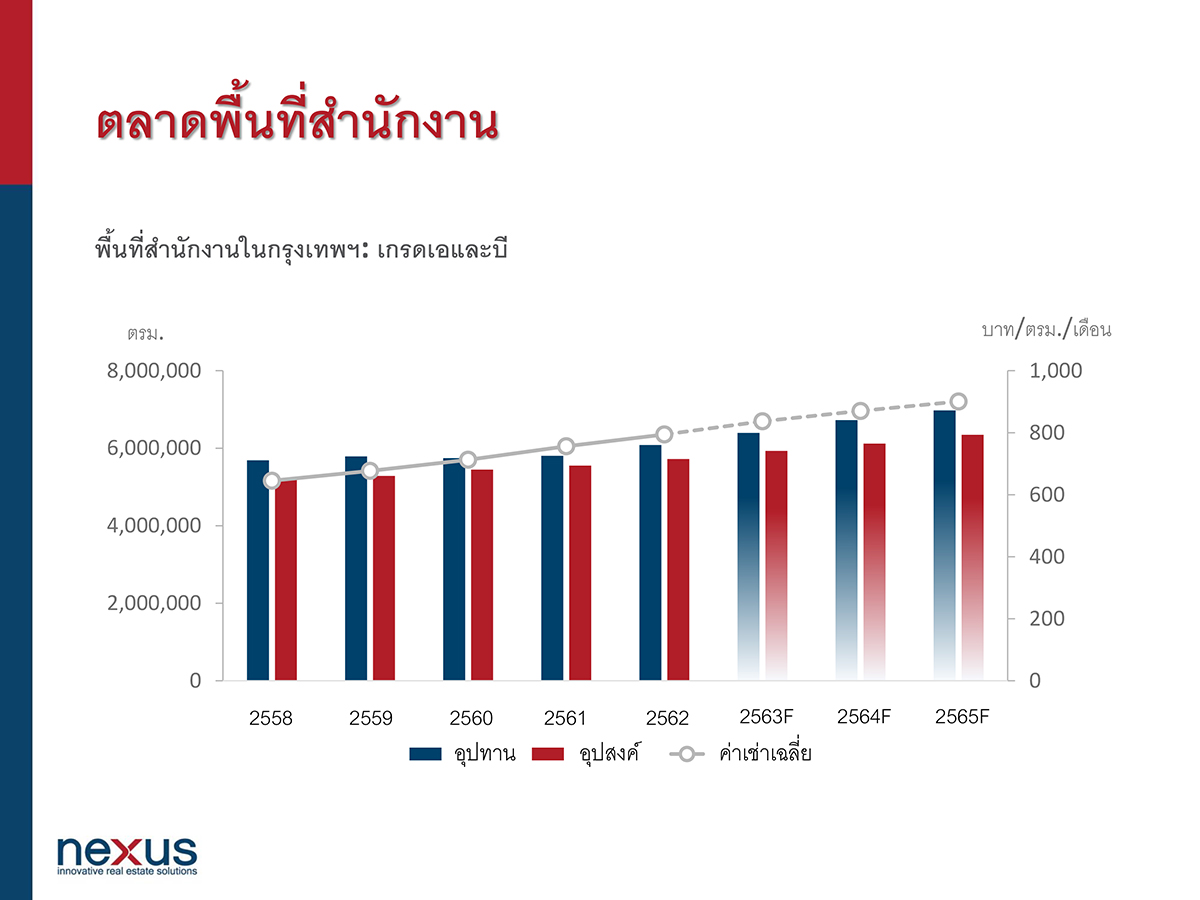

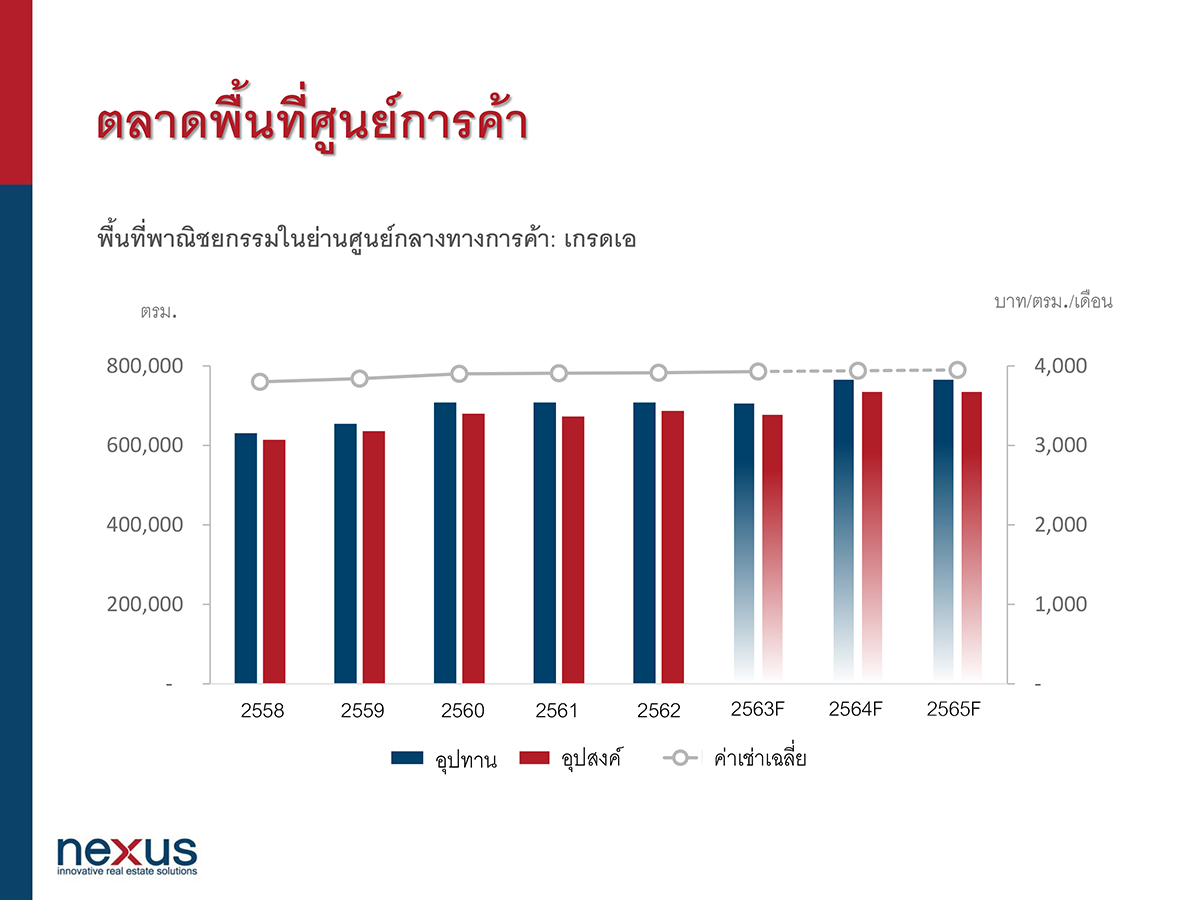

Nexus Sums Up Bangkok’s Property Market in 2019 Steady Condo Market With Good Absorbtion Rate Office Buildings, Shopping Malls Keep Growing

Nexus cites the average condominium price in Bangkok went up 1%, marking the lowest growth over the past 5 years, while the sale rate shrank 17%. It is anticipated that developers will focus more on real demand over the next two to three years. The rental rate of Grade A office in CBD area kept increasing constantly, whereas the rental rate of Grade A shopping mall rose up to 3,915 baht per square meter per month and tends to further increase. The markets of office buildings and shopping malls will face higher competition. The government’s incentive plans will be the key factor to determine the growth of property market.

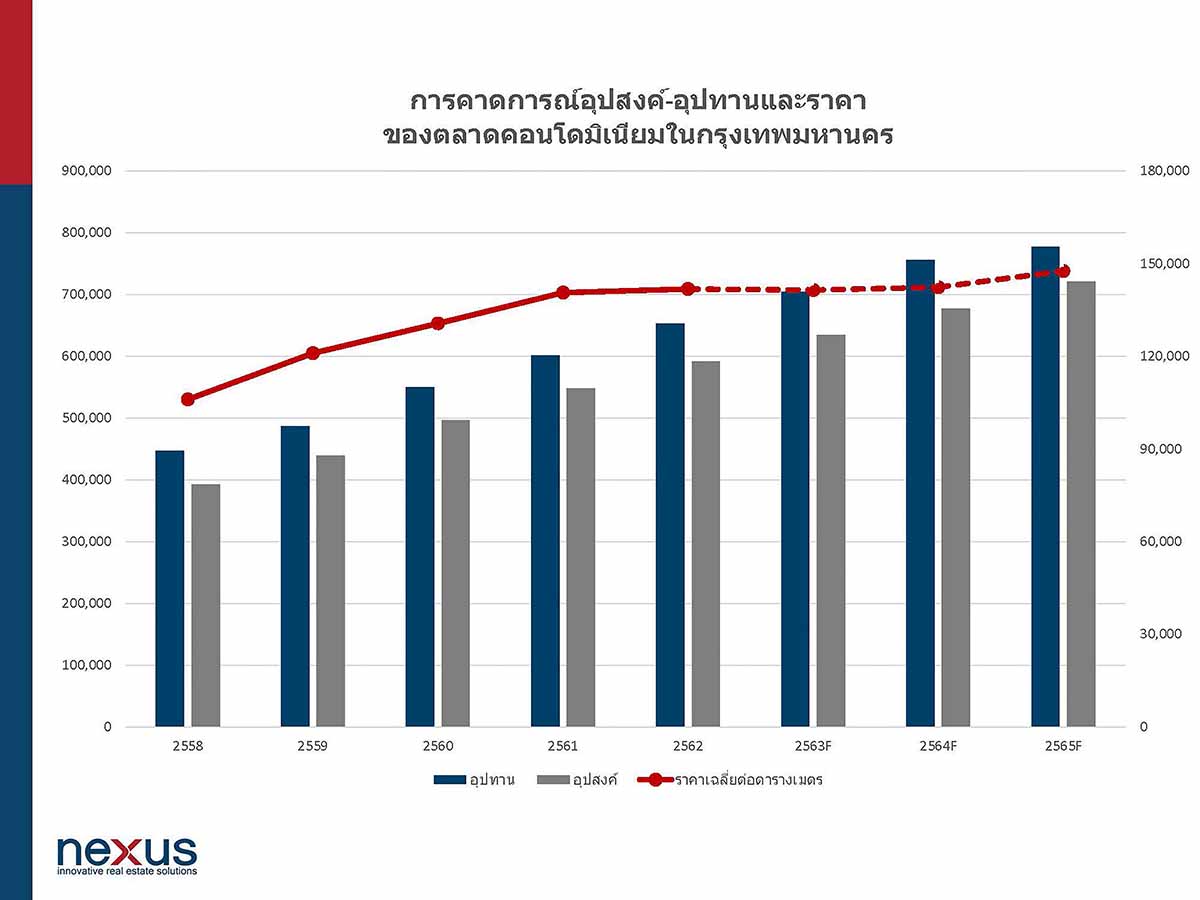

Condominium Market

Mrs. Nalinrat Chareonsuphong, Managing Director of Nexus Property Marketing Company Limited, says that supply in condominium market has declined by 29% from 2018. There were new supply of 43,000 units from 126 projects, resulting in total cumulative supply of 654,200 units. Developers shifted to focus on the extension of new mass transit lines including the MRTA Blue Line on Thonburi side, the Green Line Extension to the north and the Yellow Line. It was found that the highest new supply was in the Thonburi / Petchkasem area (10,100 units, 23%), followed by the Phra Khanong / Suan Luang area (7,800 units, 18%) and the Ladprao / Wangthonglang area (6,100 units, 14%), respectively. Considering the overall market, it indicated the growth rate of new supply in the Thonburi / Petchkasem was the highest, more than 63% over the past 5 years. The main reasons were related to inexpensive land price and extension of mass transit system projects.

To analyze new supply this year, the market experienced the big change in selling products. Almost 50% of total new supply was in the mid-market, priced between 75,000-110,000 baht per square meter, surging from 27% last year. This reflects that developers focused the potential of real demand in condominium market in Bangkok and developed their products in respond to buyer’s purchasing power. Many projects adjusted the price strategy or even paused the sale activity after the project launch to readjust the price or revise the products accordingly. Another interesting point is a sharp drop-off in hi-end market as the ratio of new projects was only 22% in 2019, compared to 40% in 2018. Meanwhile, the ratio of new development in city-condo, luxury and super luxury remain unchanged from last year.

In terms of sales, the year 2019 recorded total sales of condominium in Bangkok at 43,200 units. Of total, new supply in 2019 accounted for 20,700 units (average sales at 48%) and supply before 2019 recorded 22,500 units. The sales this year boosted the gross sales rate of overall market to 90% and there were 62,700 units remaining in the market. However, the sales rate declined 17%, still lower than the decelation rate of new supply.

It showed a better sign of the absorption rate. However, the sales would be in a better condition if the market had not suffered with the the government’s LTV measures and the appreciation of baht, dumping demand from foreigners.

Source: Nexus Research, December 2019

In 2019, the average condominium price slightly increased by 0.9% from 140,600 baht per square meter to 141,800 baht per square meter. This is considered very low, compared to the rate adjustment over the past 5 years at 8% per annum on average. The city-centered market has adjusted to real demand. The average price of newly opened projects this year was 15% lower than the one in 2018. Consequently, the average price of city-centered market was maintained at 231,300 baht per square meter. The area around the city’s center was up 1% to 114,400 baht per square meter, while the outer-ring market surged 3% to 76,000 baht per square meter.

For the investment angle, it is found that condominium projects in Bangkok were mainly invested by two groups of investors: foreign institutional investors and Thai developers. For the first group, they were mostly from China and Japan, focusing on the hi-end market. The investment from this group represented 29% of total market. The difference between the Chinese and the Japanese investors is that the Chinese invest independently, whereas the Japanese prefer a joint venture with Thai listed companies. For Thai developers, it is found that the proportion between small developers and listed ones is around 30:70. However, more small developers kept entering into the market with focusing on smaller projects.