Central Pattana becomes first company in real estate and retail industry in Thailand to join hands with UOB and ADB to launch ‘green bond’ to help push growth of mixed-use and green buildings in Thailand and abroad

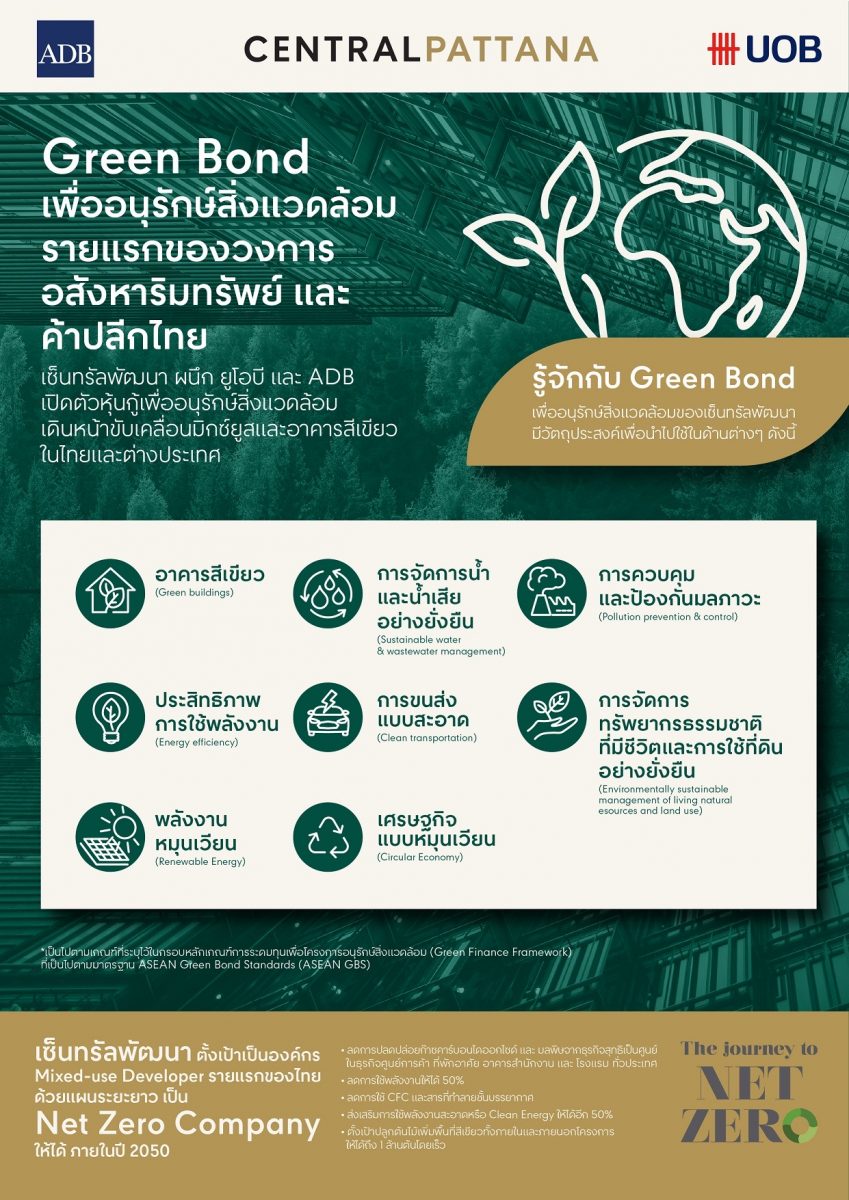

Central Pattana plc continues to create a ‘Commitment for Better Futures’ and promote environmental sustainability by issuing and offering a ‘green bond’ for the first time in Thailand’s real estate and retail industry. Central Pattana has joined hands with United Overseas Bank (UOB Thailand) to invest in projects related to renewable energy, sustainable water and wastewater management, energy efficiency improvement, green buildings and other environmentally-related projects for the company’s businesses or affiliates, which comprise various mixed-use projects including Central shopping centers, residences, office buildings and hotels nationwide. This includes future projects both domestically and internationally following the investment plan. The Asian Development Bank (ADB) has provided technical assistance under through the ASEAN+3 Asian Bond Markets Initiative (ABMI), to help develop with the aim of developing sustainable local currency bond markets in ASEAN, the People’s Republic of China, Japan, and the Republic of Korea (collectively referred to as ASEAN+3)China, Japan and Korea (collectively called ASEAN+3), and UOB Bank Thailand is the underwriter of the bonds.

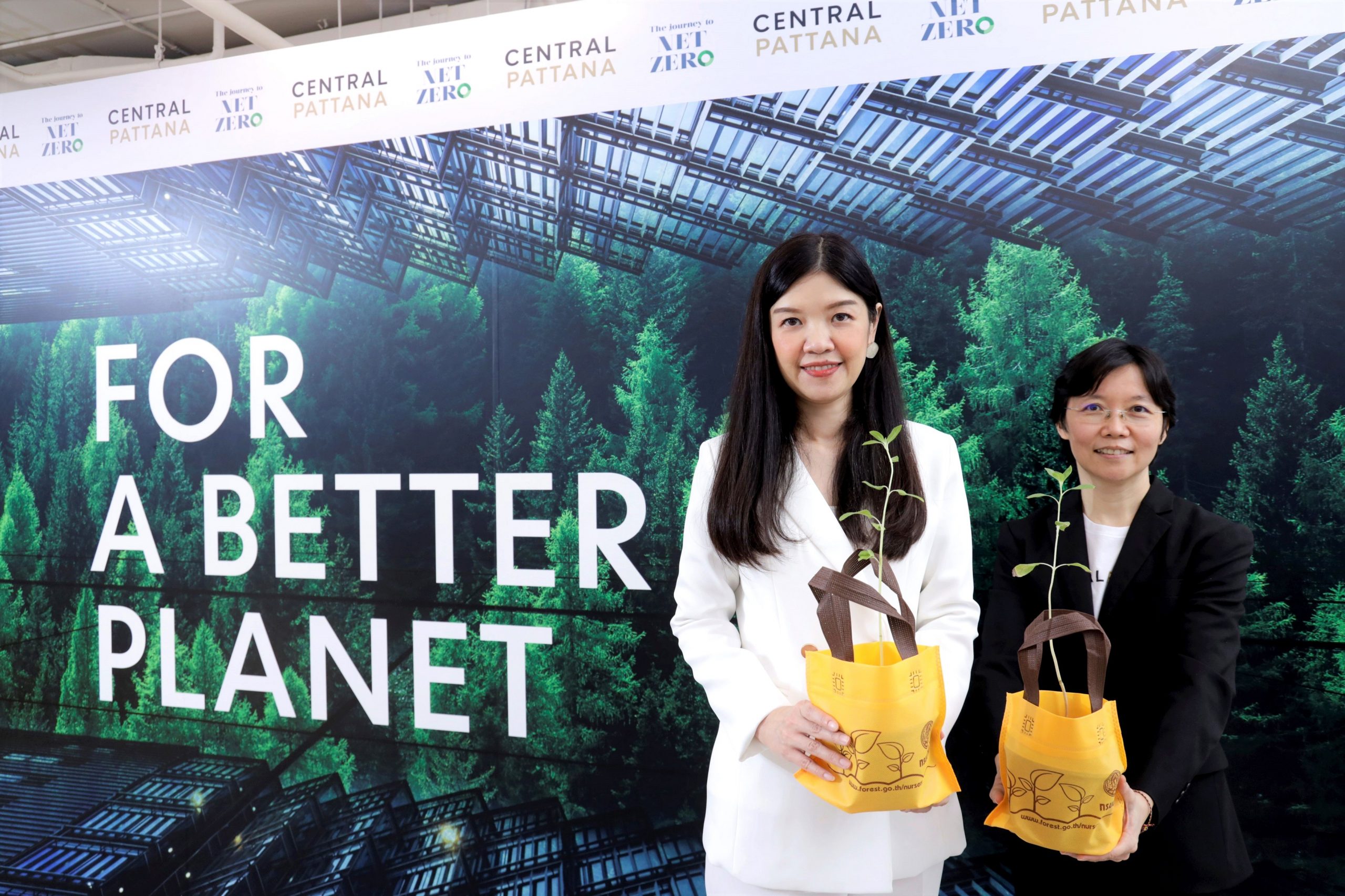

Ms. Naparat Sriwanvit, Chief Financial Officer and Senior Executive Vice President, Finance, Accounting and Risk Management and Excellence and Sustainable Development Central Pattana plc, said: “The offering of a ‘green bond’ is one of the company’s plans to focus seriously on a ‘better planet’ following the United Nations Sustainable Development Goals and the ‘Journey to Net Zero’ plan by 2050.

Central Pattana considers this an important commitment for all of us as a representative of the private sector that has been tied to Thai society for over 40 years that wishes to pass on a better environment to the planet. We have, therefore, become the first company in the Thai real estate and retail industry to launch a ‘green bond’ and our institutional investors have given great feedback on this project.”

The issuance of the bond that Central Pattana is offering to institutional investors in the amount of 2 billion baht will be distributed by United Overseas Bank (UOB Thailand), and consists of 3-year green bonds worth 1 billion baht and unsubordinated, unsecured, 3.5-year bonds worth 1 billion baht. The objective of the project is to use the proceeds from the issuance of the green bonds for projects or assets related to renewable energy, sustainable water and wastewater management, energy efficiency improvement, green buildings and other environmentally-related projects for the company’s businesses or affiliates. The projects will meet the criteria specified in the Green Finance Framework, following the Green Bond Principles (GBP) and ASEAN Green Bond Standards (ASEAN GBS), with DNV Business Assurance Australia Ltd., as an independent auditorreviewer. The bond has been rated as ‘AA credibility’ with a ‘stable’ outlook by TRIS Rating Co., Ltd.