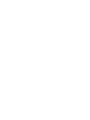

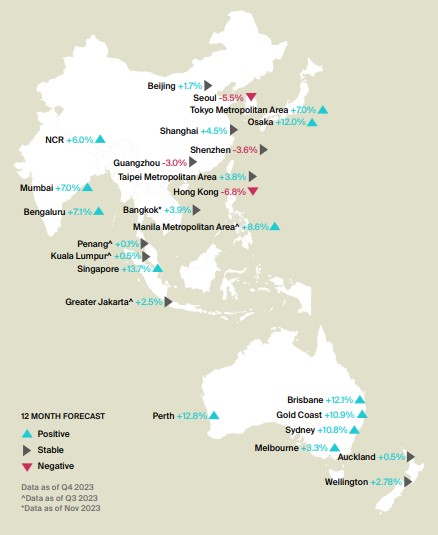

Asia leads the global prime residential market recovery accounting for four out of five top-performers in Q1 2024 (Manila, Tokyo, Mumbai and Delhi)

Asia is spearheading the global prime residential market recovery, accounting for four of the top five performing cities (Manila, Tokyo, Mumbai and Delhi) led by Manila according to Knight Frank’s latest edition of the Prime Global Cities Index. Manila leads the charge with a staggering 26.2% annual price growth, followed by Tokyo at 12.5%. Indian cities are also showing remarkable strength, with Mumbai’s prime housing market surging 11.5% and Delhi up 10.5% year-over-year. The strong 11.1% price appreciation in Perth confirms the resilience of key Australian luxury markets.

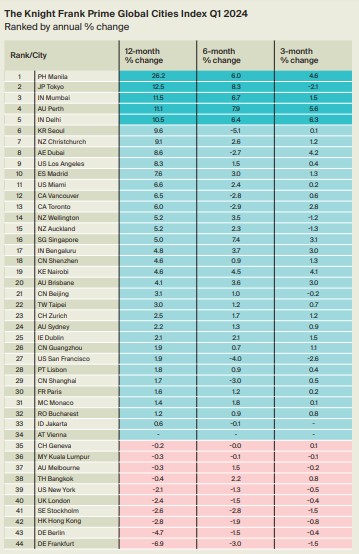

The Prime Global Cities index, which tracks luxury residential prices across 44 global cities, recorded an average annual growth rate of 4.1% in Q1 2024, marking the strongest growth rate since Q3 2022 before interest rates surged and monetary policies tightened. Quarterly price growth also strengthened to 1.1%, up from 0.3% in Q4 2023. While still below the long-term 5.4% annual average, the current 4.1% yearly increase represents a notable rebound from flat growth at end-2022.

Liam Bailey, global head of research at Knight Frank, said: “The rebound in global housing markets is continuing, as evidenced by our Prime Global Cities Index reaching 4.1% annual growth. Rather than heralding a return to boom conditions, the index indicates that upwards price pressures are stemming from relatively healthy demand, set against continued low supply volumes. The pivot in rates – when it comes – will encourage more vendors into the market, leading to a welcome return to liquidity in key global markets.”

Christine Li, head of research at Knight Frank Asia-Pacific, added: “Even among Chinese Mainland’s beleaguered property markets, prime residential prices in its tiered-one cities have largely remained resilient, which rose by an average of 2.8% year-on-year in the first quarter of 2024. This is in stark contrast to the mass residential segment, demonstrating the resilience of the prime segment as an asset class which are shielded by less price sensitive buyers and lower supply. With home buying curbs easing amid lowered downpayment and mortgage rates, policies gradually rolled out by the Chinese government to stabilise its wider property markets are likely to creep into the prime segment and remain supportive of price levels for the rest of 2024.”