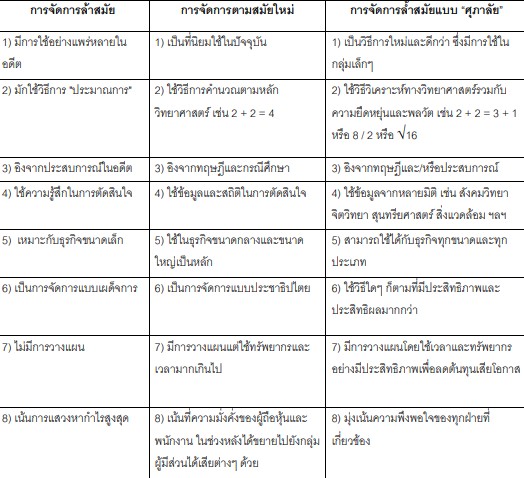

SUPALAI’ s Post Modern Management

Worldwide MBA schools in different countries & continents teach about “Risk” VS. “Return ” similarly :

“Low Risk = Low Return”

“High Risk = High Return”

But our teaching in “SUPALAI” school is in the opposite way:

“Low Risk = High Return”

Is that really possible, then “How”?

Normally, there are 2 main kinds of “Risk.”

“Business Risk”

“Financial Risk”

Our way of achieving lower “Business Risk” is :

– To avoid high risk projects & locations

– To develop the best “Quality” of products & services by applying ISO 9001:2015, Enterprise Resource Planning systems , and encouraging innovations etc.

– The best “Quality” gradually enhances “BRAND” which lower risk and gain higher revenue.

– To expand business “Horizontally” & “Vertically” and enhance growth to obtain “Economy of Scale ” which resulting lower cost & higher margin.

– To do things, not just legally, but also ethically.

To lower “Financial Risk ” we need :

– To keep low debt/equity & Gearing ratio to reduce Risk and get better credit rating.

– High Credit Rating = “A”

– Resulting in low financial cost which enable extensive “Growth” in domestic and global market

“SUPALAI”s growth patterns :

“Dual Track” Low Rise VS. High Rise developments

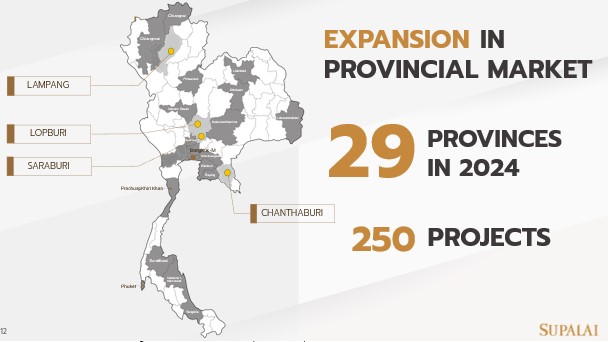

Bangkok VS. Provincial Cities

Recently “Supalai” is developing 250 projects in 29 provinces around Thailand.

“Triple Track” Furthermore, “Supalai” expanded Investment overseas to Asean Countries and “Australia”

The investments in “Australia has grown from 1 Project, 11 years ago to 24 projects in 4 states 6 cities” recently.

The “Dual Track” and “Triple Track” strategics are to increase “Potential Growth” & to “Diversify Risk” which the 2 strategics served the 2 mentioned goals very well.

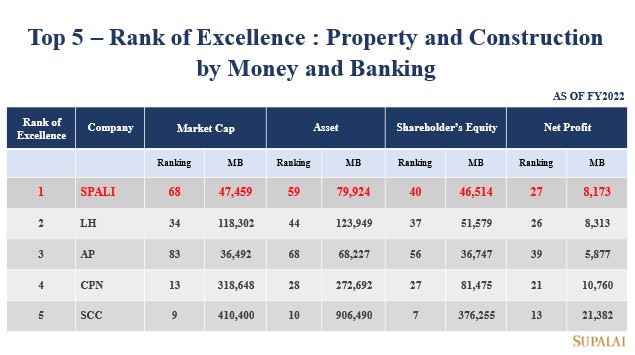

Then, what about “High Returns”?

The best way to measure “ High Return” is to benchmark with the top 10 listed companies in the same industry.