Knight Frank shares insights into four real estate sectors in 2024, competition in the age of information age, and opportunities in sluggish economy.

Knight Frank Thailand shared its vision at the “Knight Frank Foresight 2024 Pivoting Towards Opportunities” Forum, highlighting opportunities and challenges in four real estate sectors – housings, industrial, hotels, office buildings – amid stagnant demands and disabling factors. The situation of condominiums under 3 million baht is worrying due to loan rejection rate and weaker purchasing power while real demand is expected to push the sales volume of horizontal property to around 4,000 units. The industrial sector is expanding following the boom of EV vehicles and data center businesses. Meanwhile, the office building sector is seeing a surplus, yet green buildings are promising thanks to the strong ESG trend.

Mr. Nattha Kahapana, Managing Director, Knight Frank Thailand, talked about the purpose of “Knight Frank Foresight 2024 Pivoting Towards Opportunities” which was to brainstorm for opportunities in the real estate market shadowed by the economic slowdown in 2024, coupled with challenges and risk factors from within and outside the country.

Domestic factors include low inflation, household debt, rising production costs, slow growth of the housing market due to high interest rates, as well as the loan rejection rate by financial institutions. International factors stem from the uncertainty of the world economy and trade resulting from armed conflicts in many areas. Global financial markets are highly volatile due to the impact of high interest rates. All these factors pose direct and indirect impacts on the economy and the landscape of the real estate market in Thailand.

However, 2024 still sees a positive trend from rising private investment and growing private consumption as the tourism sector is recovering, together with government policies to lower cost of living and stimulate spending through the Easy E-Receipt program.

“In navigating a business through periods of volatility, acquiring timely and precise data becomes crucial for effective market analysis and strategic planning. The ability to swiftly obtain accurate information gives a competitive edge. I firmly believe that the data obtained directly from end users by Knight Frank plays a crucial role in gaining insights into overall opportunities and challenges in the real estate market. This information allows for a comprehensive understanding and a detailed analysis of specific sectors, including residential properties, industrial estates, hotels, and office buildings,” said the Managing Director of Knight Frank Thailand

Booming EV and Data Center accelerate growth in industrial sectors.

Marcus Burtenshaw, Executive Director, Occupier Strategy & Solutions, said that the rising star business to watch in 2024 is ‘Data Center’ which is attracting strong interest from domestic and international investors, signaling increasing demand in industrial sectors.

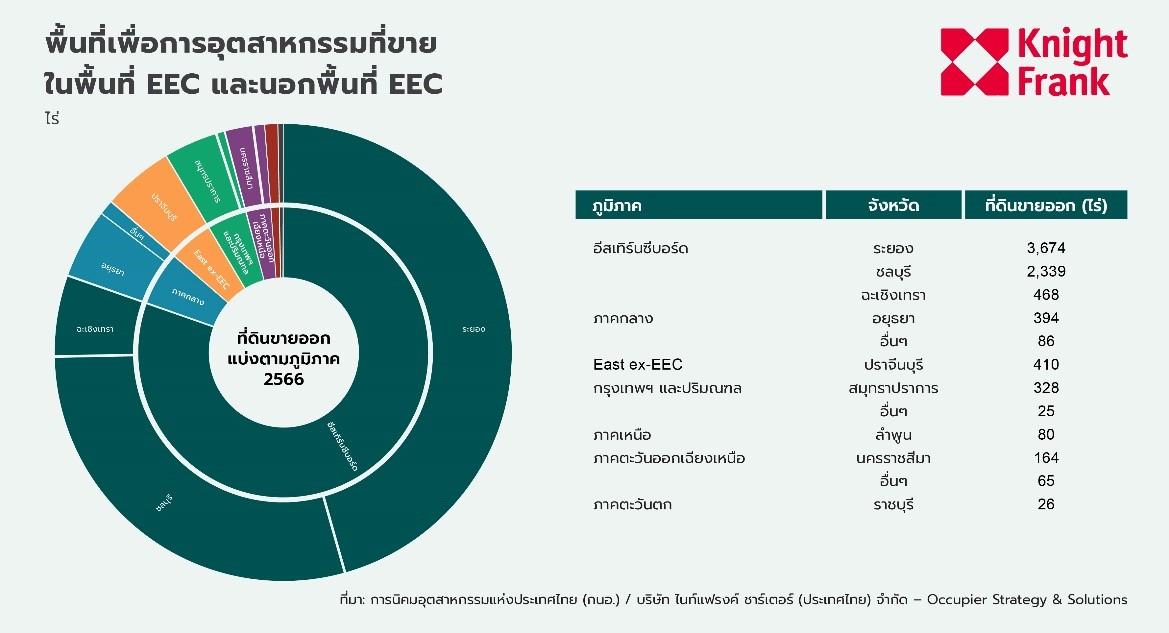

Thailand’s industry saw an excellent performance in 2023, led by the electric vehicle sector, which showed an impressive growth, not to mention electronic products that were steadily expanding. The Eastern Economic Corridor (EEC) also played a key role in attracting investors and generating over 80% of all transactions. In terms of land sale, as much as 8,867 rai of land was sold, almost double the amount of the previous year.