Luxury ski chalet prices soaring to 8-year high attracting buyers from further afield from Asia and the Middle East

Knight Frank has recently published The Ski Report 2024, which shows that the average price of a ski chalet has increased by 4.4% in the 12 months leading up to June 2023. This growth rate, except for the pandemic years, is the highest since 2014. Supply remains tight and across three key French resorts, listings are down 56% compared to pre-pandemic levels, and this is set against a backdrop of robust demand.

There are clear challenges ahead for ski resorts, not least climate change, the need to upgrade infrastructure and strict planning rules. However, the market is evolving, attracting buyers from further afield (Asia and the Middle East) and from southern Europe, as recent heatwaves prompt some second homeowners to pivot northwards. Additionally, the appeal of a base in the French and Swiss Alps, goes beyond the lifestyle to low purchase and ownership costs, the opportunity for currency diversification, and the potential for any rental income to provide a hedge against inflation in the current climate as cited by buyers.

Kate Everett-Allen, head of global residential research at Knight Frank, shares: “The pandemic-induced Alpine mini boom is ending with a fizzle rather than a bang, as limited supply keeps a floor under prices in most markets. Across three key French resorts, listings are down 56% on average compared to before the pandemic, and this is set against a backdrop of robust demand. There are clear challenges ahead for ski resorts, not least climate change, the need to upgrade infrastructure and strict planning rules. But the market is evolving, attracting buyers from further afield (Asia and the Middle East) and from southern Europe, as recent heatwaves prompt some second homeowners to pivot northwards.”

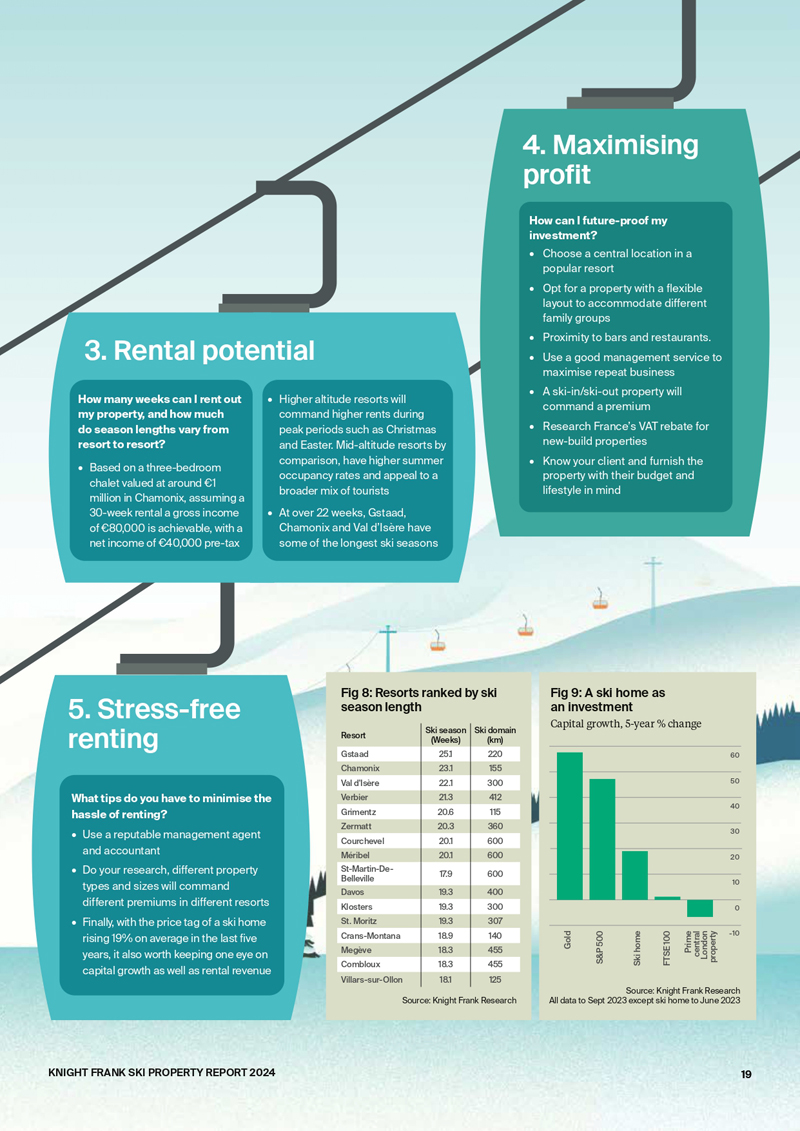

Clarice Lau, head of sales, international project marketing at Knight Frank Singapore, adds: “An Alpine home may not top the list of most high-yielding assets for investors, but the growth of year-round tourism in the Alps, a shrinking pool of homes for rent, and a packed calendar of sporting and lifestyle events are boosting landlords’ revenue. The high proportion of cash buyers in the world’s top ski resorts means the higher interest rate environment has had little impact on their appetite for a ski home. Add in the transition to hybrid working, the renewed focus on health/wellness and accumulated savings during the pandemic years, and demand remains robust. For Asia Pacific, Niseko remains the top choice for skiing destination given its location proximity, world-renowned powdery snow, year-round resort, retail, world class restaurant amenities, and favourable dollar to yen exchange rate.”

Key findings from The Ski Report 2024

– Alpine Homes Sentiment Survey: As part of the Ski Property Report, Knight Frank has run its second annual Alpine Homes Sentiment Survey, which represents the views of over 320 Knight Frank clients, located across 34 countries and territories. Respondents include existing homeowners, prospective purchasers, and those with a passion for the mountains. Key findings include:

1. Buyer motivations are diverging. Both the proportion of buyers wanting a base purely for skiing and those just wanting a base to enjoy the mountains has increased year-on-year.

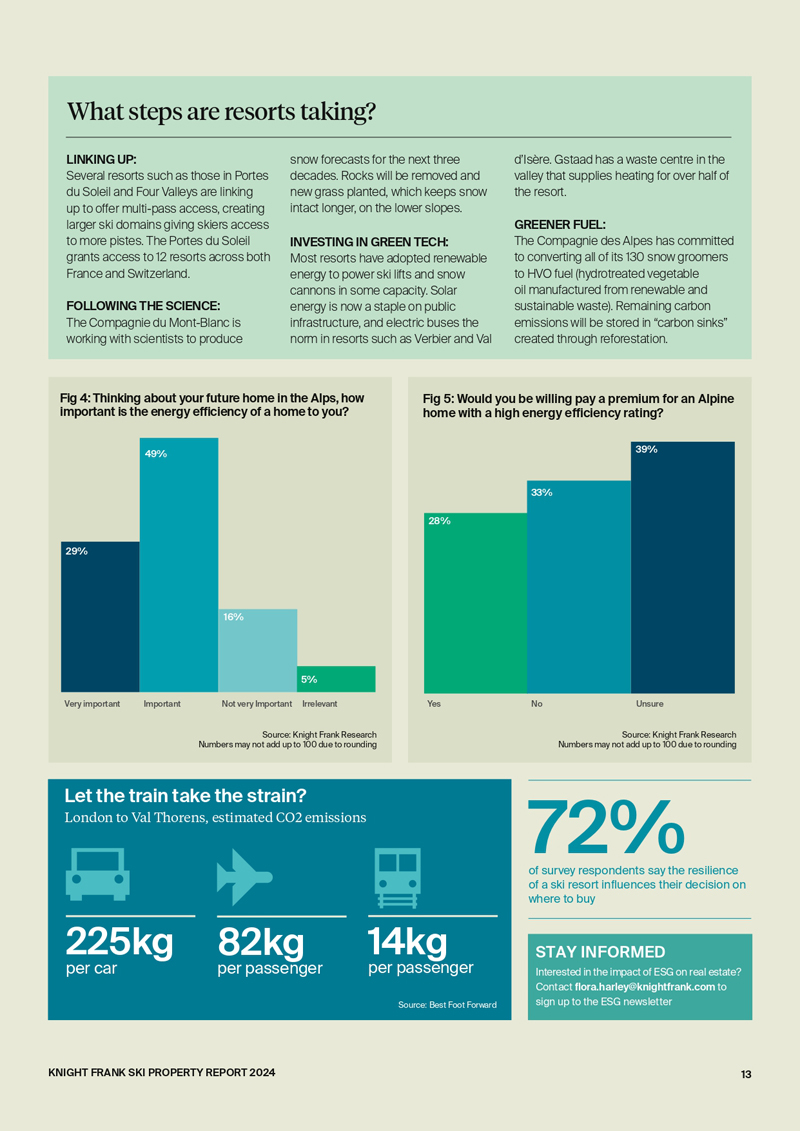

2. 72% of survey respondents say the resilience of a ski resort influences their decision on where to buy.

3. 52% of respondents are seeking a second home that they plan to rent out, up from 48% last year.

4. 78% of respondents say the energy efficiency of a home is important or very important to them, yet only 28% would be willing to pay a premium for such a home.

4. 60% of survey respondents expect the price of an Alpine property to rise in the next 12 months.

5. 39% of prospective buyers say the cost-of-living crisis has impacted the budget they will allocate to an Alpine home.