Koh Samui’s THB30.3 Billion Property Market Shifts Gear with Surge in Condos and Villa Rentals

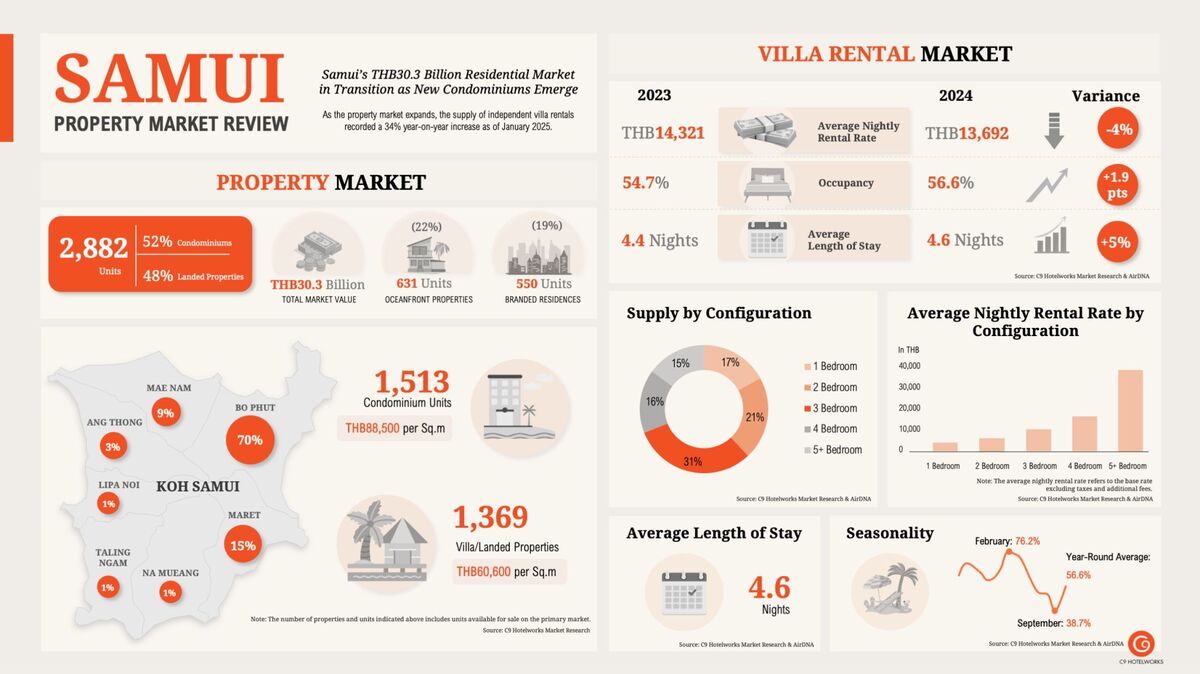

Koh Samui’s residential property market is undergoing a significant transformation, marked by rapid expansion, a diversification of offerings, and intensifying competition in the rental sector. According to the newly released 2025 Samui Property Market Update by C9 Hotelworks, the island’s property market—valued at THB30.3 billion—is transitioning from its traditional villa-centric model toward higher-density developments, especially condominiums, while adapting to evolving investment trends and rising international interest.

Booming Supply Reshapes Market Dynamics

A defining trend of Samui’s current market is the sharp increase in the supply of independent villa rentals, which grew by 34% year-on-year as of January 2025. This influx of inventory has sparked price competition, pushing down average nightly rental rates by 11% year-on-year in Q1 2025 to THB13,012. However, despite these softer rates, occupancy rose by 5.7 percentage points to 71.5%, indicating resilient demand driven by the island’s continued appeal among travelers seeking luxury and privacy. “What sets Samui apart is its fundamentally strong hotel and property market,” says Bill Barnett, Managing Director of C9 Hotelworks. “Compared to other Thai resort destinations where land prices have skyrocketed, Samui’s relatively low land cost provides a compelling platform for competitively priced luxury villas—many of which offer spectacular ocean views.”

At the same time, Samui’s residential development pipeline is seeing a clear pivot toward larger-scale, high-density resort-style condominiums. Notable among these are two upcoming projects: Anava Samui (564 units) and Wing Samui (533 units), signaling a broader diversification of the island’s residential offerings beyond traditional villas. These developments cater to a growing base of lifestyle buyers and investors looking for more affordable and manageable property options.