Demand for homes picked up after elections as property seekers remain confident of long term prospects

Elections invariably usher in a climate of economic uncertainty, as the fiscal and regulatory policies of the incoming administration largely hinge on party ideologies. These policies could significantly impact tax rates for both individuals and corporations, as well as affect public programs.

A study conducted by Professor Canes-Wrone from Princeton University and Park Jee-Kwang in 2014 indicated a downturn in housing transactions in the United States due to the policy uncertainty engendered by elections. The extent of this uncertainty, however, was dependent on the competitiveness of the race and the variance in policy agendas.

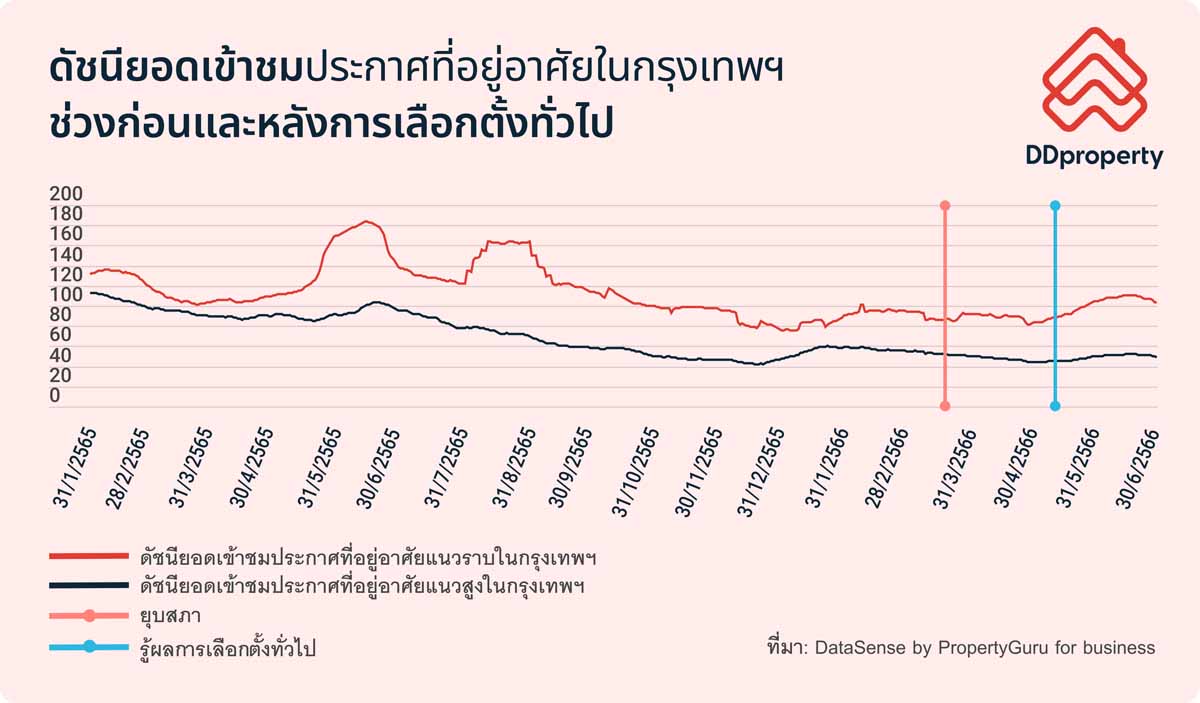

We observe a similar trend in Thailand as well during the recent election. We calculated an index based on daily visitor views on listings, employing a 30-day moving average to temper the time series. The base date was January 1, 2022. Post the dissolution of the Thai parliament on March 20, 2023, there was a slight upturn in views, which subsequently maintained a steady state.

Views for landed residential properties followed a more consistent trend, gradually tapering off until the elections drew nearer, when we noticed a slight increase in May 2023.

“It appears that property seekers, especially those considering high-value investments, generally adopt a “wait-and-see” stance during elections, pending more lucidity on prospective policy directions. Further, a subdued global economy likely augments this cautious attitude, resulting in diminished demand.” noted Dr.Lee Nai Jia, Head of Real Estate Intelligence, Data and Software Solutions, PropertyGuru Group.

Figure 1: Index for number of views of residential property in Bangkok before and after election

Source: DataSense by PropertyGuru for Business

Intriguingly, a similar trend was observed in Kuala Lumpur, Malaysia, albeit potentially exacerbated by the surge in travel during December.