FPT reports strong FY2022 year end with 58% profit growth, navigating the future with confidence

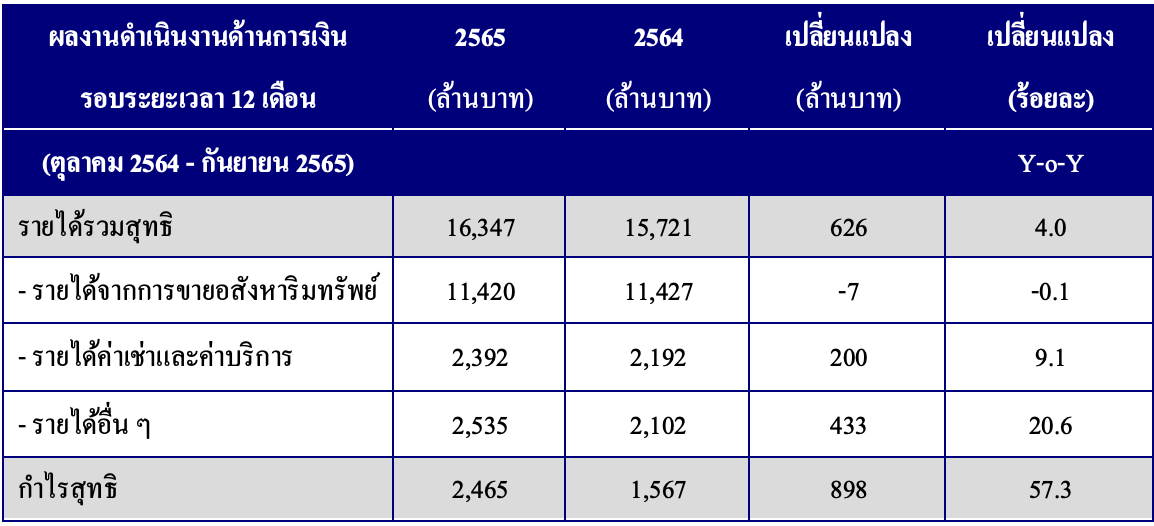

– Profit of over THB 2,465 million in FY2022 (October 2021-September 2022), representing a 57.3% increase Y-o-Y, with strong growth across the residential, industrial and commercial segments.

– The Board of Directors approves development plans for FY2023 and the dividend payment of THB 43 per share as per the ex-dividend date on 22 November 2022.

Frasers Property (Thailand) Public Company Limited (FPT) today reported its FY2022 (October 2021-September 2022) business performance, gaining a profit of over THB 2,465 million with growth of 57.3% compared to FY2021, as the residential business shifted its segment strategy to capturing the middle-upper market with high purchasing power, while pressing ahead with value-added innovations. The industrial business portfolio grew its assets under management to 3.4 million square metres, while the commercial business segment started to benefit from the country’s reopening and the recovery of the hotel industry, alongside effective cost management in every business. The company planned to make a dividend payment to shareholders at THB 0.43 per share as per the ex-dividend date on 22 November 2022. In line with its strong performance, FPT has retained its “A” credit rating with a “Stable” outlook for the second consecutive year by TRIS Rating.

Mr. Thanapol Sirithanachai, Country CEO of Frasers Property (Thailand) Public Company Limited, said: “The company’s FY2022 business performance achieved a strong performance with all three business segments, including residential, industrial and commercial real estate, contributing substantially to this year’s significant growth. Net profit increased 57.3% from the year before, representing a margin of 15.1%. We are optimistic of the industry’s growth prospects as the wider economy recovers following the pandemic, and all business segments are ready to roll out new development plans including a greater focus on sustainability and innovation to take full advantage of opportunities.”

For the residential business, a total of 18 projects was launched in FY2022 (October 2021-September 2022), valued over THB 20 billion baht. Its key strategy is to expand the market to capture customers in the middle-upper segment that has high purchasing power, along with integrating value-adding innovations into house functions and common facilities, among which include Frasers Clean & Cool Air technology for the purpose of air ventilation and the EV Charger system. Hence, the overall fiscal year achieved a revenue of THB 11,420 million with a gross profit margin increasing from 25% in FY2021 to 32% in FY2022. The Grand and Grandio received overwhelming feedback.

For the industrial business, factories and warehouses under the management portfolio increased from 3.01 million sqm at the end of FY2021 to 3.4 million square meters at the end of FY2022 (30 September 2022). The strategic investment in Indonesia fortified rental income streams. Similarly, the overall fiscal year attained an average occupancy rate of up to 85% and generated extra income from asset divestment to the REIT resulting in a total THB 3,198 million.

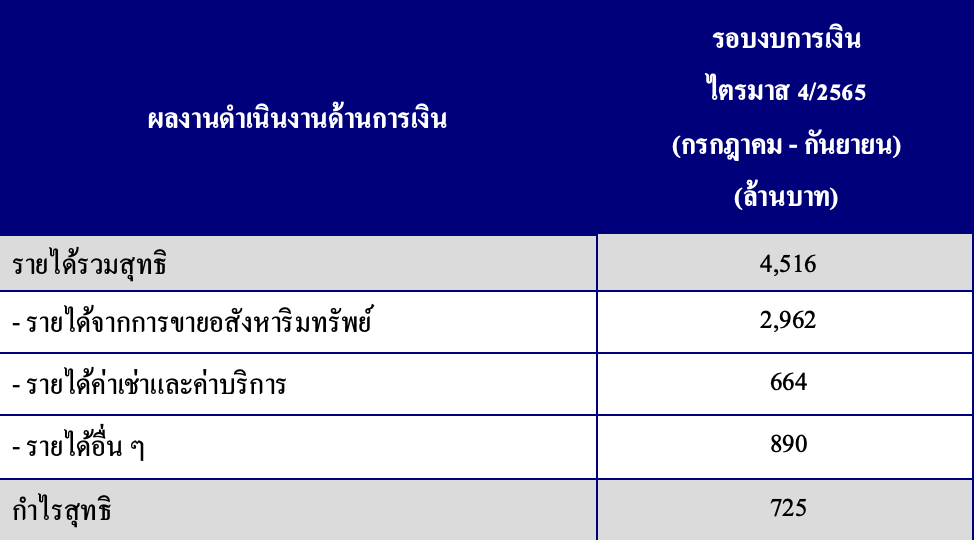

On the other hand, the commercial business steadily recovered following the easing COVID-19 situation, the reopening of the country, and economic stimulus policies. Accordingly, the hotel segment’s revenues growing more than 100%. In parallel, the phased opening of Silom Edge during the fourth-quarter (July-September 2022) resulted in the company gradually recognising new sources of revenues. Overall, the occupancy rate of commercial business remains strong at over 90%.

“The focus is placed on the parallel growth of all three business segments to create sustainable growth regardless of economic conditions. At the same time, we will continue to strive to remain disciplined with effective cost management, and have decreased the company’s overall costs in FY2022 by 3%,” Mr. Thanapol added.